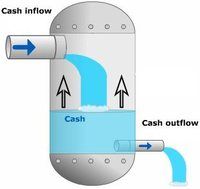

The movement of actual cash into and out of a business's operations, investments, and financing activities is referred to as cash flow in the business world. It's an essential statistic for evaluating a company's financial stability, liquidity, and capacity to balance short-term responsibilities with long-term expansion.

When discussing investor finances for a firm, the term "cash inflow" refers to the funds that are received from investors and raise the company's cash balance. These funds are crucial for a company's growth and sustainability since they support a variety of financial activities, from daily operations to strategic expansion.

You receive cash in return for an asset when you sell it. This incoming cash is an example of a cash influx because it raises your accessible cash balance. Assets can be sold, including things like real estate, machinery, vehicles, and investments. The proceeds from the sale of these assets may be applied in a number of ways,

The act of paying rent entails parting with cash to defray the expense of utilizing a building or area. Because money is leaving your possession to pay a debt, this constitutes a cash outflow.

Purchasing an asset requires making a financial commitment. This expense is a cash outflow because it reduces your available cash balance.

For a company or an individual, a positive net cash flow is preferable. The difference between cash inflows (money coming in) and cash outflows (money going out) over a certain period is referred to as net cash flow. A positive net cash flow shows that more money is coming in than is leaving the company, which is a sign that it is financially healthy.

The movement of money from a company or person to another party for expenses, payments, or expenditures is referred to as an outflow. A business can grow its cash on hand by managing its expenses more skillfully by minimizing outflows. This decrease in outflows can be achieved through techniques like cost-cutting, spending optimization, supplier renegotiation, and effective resource allocation.

Advertisement

The company's cash is growing since there is more cash coming in than going out.

If the corporation sells 400 devices for $15 apiece, it makes $6,000 in revenue.

If 500 units are produced at a cost of $2,000, the average total manufacturing cost is $4 per unit. This indicates that the average cost of producing each unit is $4.

A company's overall expenses can be broken down into two categories: fixed costs and variable costs.

Delaying the process of paying overdue invoices or other payments owing to suppliers and vendors is referred to as the option to delay paying suppliers. Although it might offer short-term respite from cash flow problems, this strategy should be used with caution.

Profit is different from cash flow.

Financial tools called cash flow projections are used to predict how much money will flow into and out of a company over a given time period, typically in the short to medium range. For organizations to successfully manage their financial operations and make choices, they are crucial. Assessing whether a company will have enough cash on hand to meet its financial obligations and pay for various expenses is the main goal of cash flow projections.

Advertisement

inflows (money coming in) and cash outflows (money going out) causes cash flow concerns in a business (money going out). Giving consumers a long credit period might make it more difficult to manage cash flow because payments are delayed and accounts receivable collection processes are longer.

Financial techniques called cash-flow forecasts are used to predict how much money will flow into and out of a company over a given time period. Despite being intimately tied to a company's operational and financial features, they mostly concentrate on cash inflows and outflows rather than the company's overall profitability.