Explanation:

Option 2 is correct. Reverse mortgages do not require monthly mortgage payments. Option 3 is correct. Both partners need to be over 55 years of age to be eligible is correct.

Explanation:

As a family with low income, they qualify to receive the quarterly GST payment.

Explanation:

They would owe $10,000 (the amount of the deductible) plus $4,500 ($90,000 balance x 5% co-insurance) equals $14,500. The deductible is always first when making the calculation.

Explanation:

Yulia is proactively trying to determine the amount of funds Sarah will need to have available from her investments in the near term. This would be a key determinant of the client's liquidity needs.

Explanation:

N=36, 1=3.5%/12=0.291667%, FV=0, PV=280,000

1st year PMT=-8,205

Balance of the loan = -8,205*PVIFA(I=3.5%/12,N=24)=189,909

N=24, I=4.5%/12=0.375%, FV=0, PV=189,909

2nd vear PMT=-8,289

Balance of the loan = -8,289*PVIFA(I=4.5%/12,N=12)=97,087

N=12, =5.5%/12=0.458333%, FV=0, PV=97,087

3rd year PMT=-8,334

Explanation:

Options 2 and 3 are correct. The liability of the owners or shareholders of a limited liability company is limited to the amount of their shareholding in the company. The partners of a partnership and sole proprietors are personally liable for all claims and liabilities with respect to their business.

Explanation:

PV = 250,000; PMT=2,500; N=12*20

Compute I=0.877009% → annual rate = 10.524%

Also, NPV=200,777.29 >0 using a 3% discount rate (monthly rate: 0.25%)

Advertisement

Explanation:

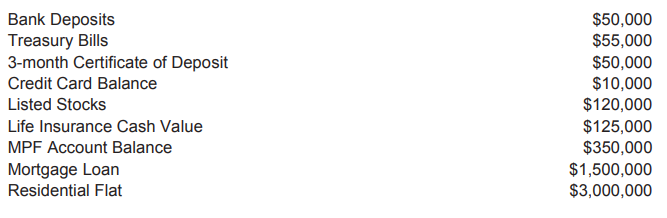

Net Worth = Total Assets - Total Liabilities

Total Assets= Bank Deposits + Treasury Bills + Certificate of Deposit + Listed Stocks + Life

Insurance Cash Value + MPF Account Balance + Residential Flat = $3,750,000

Total Liabilities=Credit Card Balance + Mortgage Loan= $1,510,000

Net worth $3,750,000 - $1,510,000 = $2,240,000

Explanation:

Calculation of PV of a future stream of income:

N=30, I={(1.08/1.03)-1=4.854369%

PMT=(-600,000 x 70%)*1.03^12 =-598,819.57

FV=-3m

PV=10.08m

Explanation:

Net worth=Total assets-total liabilities → $719,000-$91,000=$628,000

Debt ratio = liabilities/net worth → $91,000/$628,000=0.1449

Explanation:

2 & 3 are correct. Due to Robert's job nature and the economic situation, Robert will likely suffer a period of reduced income which will last for a while. As such, he should reduce discretionary spending and financial responsibilities.