FREE Financial Ratios Questions and Answers

A current asset account is not which of the following?

Fixtures is NOT considered a current asset. Fixtures is included in property, plant, and equipment, which is a category of long-term assets for a business.

The current asset LESS the current liabilities

The difference between a company's current assets and current liabilities is known as working capital. It represents the money a business has available to pay for short-term financial obligations as well as ongoing operational costs.

Current resources Amount of current liabilities divided by the

A financial metric called the current ratio assesses a company's liquidity and ability to meet short-term obligations. It is determined by dividing the current assets by the current liabilities of the company.

Which account is NOT included in the quick ratio?

Stock is NOT regarded as a quick asset. The items that can be converted into cash Cash, Temporary Investments, and Accounts Receivable are included in the quick ratio.QUICKLY

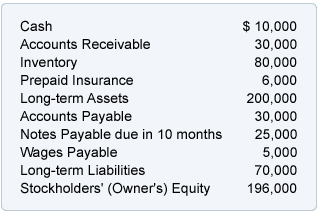

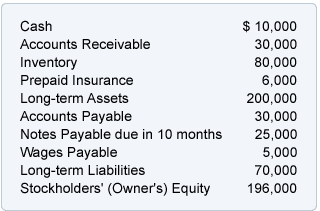

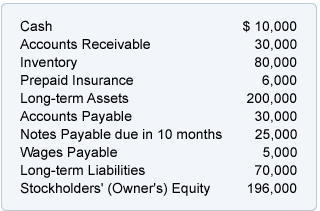

Working capital for the business is

Current assets minus Current Liabilities equals Working Capital. In this instance, that translates to $66,000 – $60,000 = $126,000.

The current ratio for the business is

The current ratio is calculated as [current assets / current liabilities]: 1. That amounts to [$126,000 DIVIDED BY $60,000]: 1 = 2.1 : 1.

The quick ratio of the business is

The quick ratio or acid test ratio equals [(Cash + Temporary Investments + Accounts Receivable) / Current Liabilities]: 1 = [($10,000 + $0 + $30,000) / $60,000]: 1 = 0.66667: 1 or 0.7: 1 when rounded.

Advertisement

A company had $830,000 in Sales (all on credit) and $525,000 in Cost of Goods Sold in its most recent fiscal year. Its Accounts Receivable were $80,000 and its Inventory was $100,000 at the beginning of the year. Accounts Receivable were $86,000 and Inventory was $110,000 at the end of the year.

The annual inventory turnover ratio was

The cost of goods sold / average inventory is known as the inventory turnover. This amounts to $525,000 DIVIDED BY $105,000 = 5.0 in this instance.

A business had $830,000 in sales (all on credit) and $525,000 in cost of goods sold for the most recent year. It had $100,000 in inventory and $80,000 in accounts receivable at the start of the year. At the end of the year, its inventory was worth $110,000 and its accounts receivable were $86,000.

The ratio of accounts receivable turnover was

The credit sales divided by the average accounts receivable is the accounts receivable turnover. That means that in this instance, $830,000 / $83,000 = 10.0.

A company's most recent year saw sales of $830,000 (all on credit) and cost of goods sold of $525,000. Its inventory was $100,000 and its accounts receivable were $80,000 at the start of the year. Its inventory was worth $110,000 and its accounts receivable were $86,000 at the end of the year.

How many days' worth of sales were typically in accounts receivable throughout the year?

Divided by the accounts receivable turnover rate of 10.0, 365 days in a year would equal 36.5 or 37 days of sales in accounts receivable.

A company's most recent year saw sales of $830,000 (all on credit) and cost of goods sold of $525,000. Its inventory was $100,000 and its accounts receivable were $80,000 at the start of the year. Its inventory was worth $110,000 and its accounts receivable were $86,000 at the end of the year.

How many sales days were held in inventory on average throughout the year?

Divided by the inventory turnover rate of 5.0, 365 days would equal 73 days, or the number of days sales occur in inventory during the year.

The most recent year's net income after tax for a company was $400,000. The company's income statement showed expenses for interest and income taxes totaling $140,000 and $60,000, respectively. The company's stockholders' equity was $1,900,000 at the beginning of the year and $2,100,000 at the end.

What is the company's times interest earned?

The earnings of the company before interest and income tax expense are divided by the amount of interest expense to determine the times interest earned. In this instance, the earnings before interest and income tax expenses come to $600,000. This is calculated as follows: $400,000 + $140,000 + 60,000. By dividing that sum by the $60,000 in interest costs, we get 10.0.

The most recent year's net income after tax for a company was $400,000. The company's income statement showed expenses for interest and income taxes totaling $140,000 and $60,000, respectively. The company's stockholders' equity was $1,900,000 at the beginning of the year and $2,100,000 at the end.

What is the stockholders' equity return for the year, after taxes?

The company's net income after taxes DIVIDED BY the average stockholders' equity for the year results in the return on equity. In this instance, it means that $400,000 / $2,000,000 = 20%.

Which of the following will likely have the reported amounts on the balance sheet closest to their present value?

The current value is relatively close to the recorded and reported amounts because current assets typically "turn over" within a year. Additionally, the current values of current liabilities would be similar to the reported amounts.

Advertisement

On a company's balance sheet, its stellar reputation will be listed as one of its assets.

In the accounting records, only transactions with a measurable dollar amount are included.

When a manufacturer's net income exceeds its cash flow from which activities, its earnings are of questionable quality.

When a manufacturer's net income exceeds the cash flow from operating activities, the quality of those earnings is questionable. The company's financial stability and the sustainability of its reported earnings may be questioned in light of this circumstance.