FREE AFP Financial Management Questions and Answers

Francis, age 65, and his wife Elena, age 55, are both retired and are looking to access the value of their 3-bedroom bungalow. The couple can access the unencumbered value of the property with a reverse mortgage. What of the following is true regarding a reverse mortgage?

1. 65% of home equity can be converted on a tax-free basis

2. Do not require monthly mortgage payments

3. Both partners need to be over 55 years of age to be eligible

4. Both partners need to be over 60 years of age to be eligible

Explanation:

Option 2 is correct. Reverse mortgages do not require monthly mortgage payments. Option 3 is correct. Both partners need to be over 55 years of age to be eligible is correct.

Andrew and Leah have two children under the age of 15. They have a low family net income of $28,000 and cash flow is an issue. Last year, their parents gave them $1,000 each that they contributed to an RESP for their children. Their other assets include compound interest GICs due in 3 years and Andrew’s membership in his employer’s Group RRSP. If Leah is completing a cash flow summary to protect her family’s expenditures, which item(s) will impact their cash flow?

Explanation:

As a family with low income, they qualify to receive the quarterly GST payment.

Janice and Susie bought a commercial property 5 years ago as an investment. They recently purchased property insurance that included both a deductible and coinsurance provisions. The deductible was $10,000 and for the co-insurance, they would have to pay 5% of any claim. If they were to make a claim on their commercial property for $100,000 in damages, how much would they have to pay themselves to cover the claim?

Explanation:

They would owe $10,000 (the amount of the deductible) plus $4,500 ($90,000 balance x 5% co-insurance) equals $14,500. The deductible is always first when making the calculation.

Yulia, an advisor, asks her client Sarah about upcoming major expenditures in the next 24 months. Yulia would like to anticipate any planned expenditures for Sarah that will alter her current financial plans. What planning consideration is Yulia proactively anticipating in this scenario?

Explanation:

Yulia is proactively trying to determine the amount of funds Sarah will need to have available from her investments in the near term. This would be a key determinant of the client's liquidity needs.

Ronald has taken out a car loan of $280,000 to be repaid over 3 years. Interest rate is at 3.5% for the first year, 4.5% for the second year, and 5.5% for the third year. Calculate Ronald's monthly payment in the first, second, and third years respectively.

Explanation:

N=36, 1=3.5%/12=0.291667%, FV=0, PV=280,000

1st year PMT=-8,205

Balance of the loan = -8,205*PVIFA(I=3.5%/12,N=24)=189,909

N=24, I=4.5%/12=0.375%, FV=0, PV=189,909

2nd vear PMT=-8,289

Balance of the loan = -8,289*PVIFA(I=4.5%/12,N=12)=97,087

N=12, =5.5%/12=0.458333%, FV=0, PV=97,087

3rd year PMT=-8,334

Which of the following types of business ownership imply that the nature of the liability of the owners) with respect to the business is a personal one?

1. Limited liability company.

2. Partnership.

3. Sole proprietorship.

Explanation:

Options 2 and 3 are correct. The liability of the owners or shareholders of a limited liability company is limited to the amount of their shareholding in the company. The partners of a partnership and sole proprietors are personally liable for all claims and liabilities with respect to their business.

Ruby is 60 years old and expects to live until at least age 80. She is considering a proposal of an annuity from an insurance company. For a premium of $250,000, the annuity will pay her $2,500 per month for the rest of her life until she passes away. Assume Ruby invests her savings in US Treasury Bills (US T-Bills) earning a rate of return of 3% p.a. Which of the following statements about the proposed annuity and the US T-Bills are CORRECT?

1. The rate of return on the annuity is higher than the rate of return on US T-Bills.

2. The rate of return on the annuity is the same as the rate of return on US T-Bills.

3. The rate of return on the annuity is lower than the rate of return on US T-Bills.

4. The present value of benefit payments to be made from the annuity is worth more than its premium.

5. The present value of benefit payments to be made from the annuity is worth less than its premium.

Explanation:

PV = 250,000; PMT=2,500; N=12*20

Compute I=0.877009% → annual rate = 10.524%

Also, NPV=200,777.29 >0 using a 3% discount rate (monthly rate: 0.25%)

Advertisement

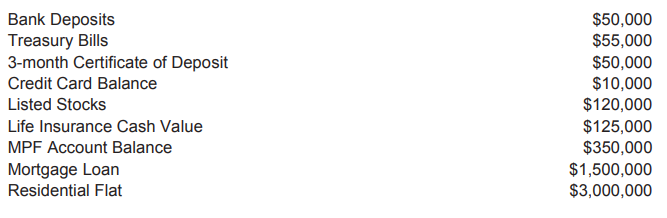

Jonathan is applying for a personal loan from a local bank. As part of its standard procedure for loan assessment, the bank has asked him to provide his financial information. Jonathan provides the requested information as follows:

What is Jonathan's net worth?

Explanation:

Net Worth = Total Assets - Total Liabilities

Total Assets= Bank Deposits + Treasury Bills + Certificate of Deposit + Listed Stocks + Life

Insurance Cash Value + MPF Account Balance + Residential Flat = $3,750,000

Total Liabilities=Credit Card Balance + Mortgage Loan= $1,510,000

Net worth $3,750,000 - $1,510,000 = $2,240,000

Mr. and Mrs. Yung, both aged 48 and each with a life expectancy of 90 have a current annual household income of $600,000. They would like to retire in 12 years' time on 70% of their current income adjusted for inflation. They also wish to leave an estate of $3 million to their only daughter, Tina, upon their deaths. The inflation rate is expected to be 3% p.a. In order to achieve the Yungs' objectives, how much capital should they accumulate at age 60 if the expected rate of return is 8% p.a.?

Explanation:

Calculation of PV of a future stream of income:

N=30, I={(1.08/1.03)-1=4.854369%

PMT=(-600,000 x 70%)*1.03^12 =-598,819.57

FV=-3m

PV=10.08m

Mr. and Mrs. Chan are a young married couple. The following shows some of their financial figures:

Based on the figures provided, calculate the debt ratio of the Chan couple.

Explanation:

Net worth=Total assets-total liabilities → $719,000-$91,000=$628,000

Debt ratio = liabilities/net worth → $91,000/$628,000=0.1449

Robert is a 35-year-old single male who has just lost his job as a salesperson due to the recent economic downturn. Which of the following are appropriate actions that Robert's financial planner should recommend he take in the event of a prolonged period of reduced income?

1. Keep up his monthly savings plans.

2. Reduce his discretionary spending.

3. Reduce his financial responsibilities.

Explanation:

2 & 3 are correct. Due to Robert's job nature and the economic situation, Robert will likely suffer a period of reduced income which will last for a while. As such, he should reduce discretionary spending and financial responsibilities.