UCAT Quantitative Reasoning Test #3

For the fiscal years 2010-2011, the government spent 120 billion dollars on Health Services and 190 billion dollars on "Social Protection." In the same year, government spending on "Debt Interests" was 33.33 percent of government spending on "Health Services," with "Health Services," "Social Protection," and Debt Interests accounting for 50% government spending. What was the government's total spending in the fiscal year 2010-11?

Correct answer: 700 billion dollars

The government spends 120 billion dollars on health services.

The government spending on Debt Interests = 0.3333 x 120 billion dollars = 39.996 billion dollars

The sum of spending on Health Services, Social Protection and Debt Interests =120 + 190 + 39.996 = 349.996 billion dollars

349.996 x 100/50 = 699.992 billion dollars is the total government spending.

The population of snow leopards in Country A is 40% of the population of snow leopards in Country B. Country C has half the population of Country A when it comes to snow leopards. What is the population of snow leopards in Country B if Country C's population is 520?

Correct answer: 2,600

Let Country A's snow leopard population be x.

Let the snow leopard population in Country B be y. x = 0.4y

Country C has 520 snow leopards population, however this is 50% of x. As a result, 0.5x = 520 and x = 1040.

Since, x = 0.4y, y = 1040/0.4 = 2,600

Every year, a city hosts a children's festival. In Year 1, the festival had five events, with a total of 344,250 children participating in all of them. In Year 2, there were six events, and the average number of children who participated in all of them was 12% higher than in Year 1. What was the total number of pupils that took part in all of the Year 2 events?

Correct answer: 462,672

In Year 1, the average number of pupils who participated was 344,250/5 = 68,850.

In Year 2, the average number of pupils who participated was 68,850 x 112/100 = 77,112

In Year 2. the total number of children participating = 77,112 x 6 = 462,672

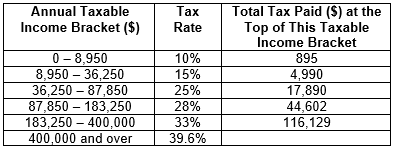

The table displays the total amount of tax paid on the yearly taxable income.

For instance, someone with a $60,000 annual taxable income will pay $4,990 plus 25% of ($60,000 $36,250).

Explanation:

Bill pays $895 on his first $8,950.

Remaining taxable income: $28,950 − $8,950 = $20,000

15% tax on $20,000 = $3,000

Total tax: Tax from lowest tax bracket ($895) + tax from next bracket ($3,000) = $3,895

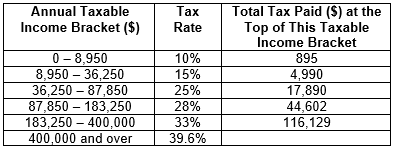

The table displays the total amount of tax paid on the yearly taxable income.

Cathy makes $2,500 per month in taxed income annually. She aims to set up enough cash each month to cover her annual taxes.

Cathy must set aside at least the following sum each month, rounded up to the closest dollar:

Her income tax is as follows, rounded up to the next dollar:

Explanation:

taxable income per year: ($2,500) x months in the year (12) = $30,000 in monthly taxable income

Tax on the first $8,950 of taxable income per year is $895.

Taxable income still due: $30,000 x 8,950 = $21,050

Tax of 15% on $21,050 = $3,157.50

Total tax: $895 from the lowest tax rate plus $3,157.50 from the next tax level = $4,052.50.

Total monthly savings needed to pay annual taxes: Taxes in total ($4,052.50) The number of months in a year (12)

= $338 to the closest dollar.

The table displays the total tax paid (in pounds) on the taxable income for the year.

For instance, someone with a taxable income of £45,000 per year would pay £4,125 plus 20% of (£45,000 - £31,500).

Ronald makes $23,330 in taxable income per year. He must pay the following income tax, rounded to the nearest £:

Explanation:

The second tax rate includes income of $23,300... £1,200 is the result of 10% taxation on £12,000. (as shown in the RH column)

The remaining amount (£23,330 - £12,000) = £11,330 is taxed at a rate of 15%, producing a total of £1,699.50 and £2,900. (4sf)

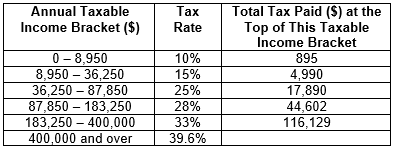

The table displays the total amount of tax paid on the yearly taxable income.

For instance, someone with a $60,000 annual taxable income will pay $4,990 plus 25% of ($60,000 $36,250).

Arman earns $36,250 in taxable income annually.

What proportion of his taxable income, exact to one decimal place, does Arman pay in taxes?

Explanation:

The total tax paid at the top of this taxable income bracket, as shown in the second row of the table, is $4,990.

The highest income in this category belongs to Omar, whose taxable income is $36,250.

Percentage of Omar's taxable income equal to $4,990

Correct to one decimal place: 13.8 percent using the formula $4,990 ÷ 36,250 x 100.

The table displays the total tax paid (£) on the taxable income for the year.

For instance, someone with a taxable income of £45,000 per year would pay £4,125 plus 20% of (£45,000 - £31,500).

Olivia earns £114,050 a year in taxable income. She must pay the following income tax:

Explanation:

£5,050 is the tax bracket for income over £114,050:

According to the RH column, the first £81,450 generates £16,500 in taxes.

The remaining £32,600 (£114,050 - £81,450) is then taxed at a rate of 37 %, giving a final result of £12,062 and a total of £28,562.

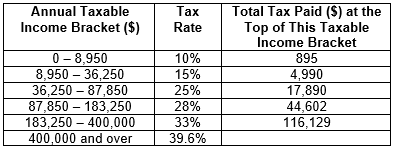

The table displays the total amount of tax paid on the yearly taxable income.

For instance, someone with a $60,000 annual taxable income will pay $4,990 plus 25% of ($60,000 $36,250).

Each income tax bracket will see a 10 percent increase in the numbers at the bottom and top of the bracket.

What will the individual's adjusted gross income, to the closest dollar, be if their taxable income is $36,250?

Explanation:

The $8,950 in the lowest tax bracket rises by 10% to become $9,845

Tax on $9,845 at 10% = $984.50

The remaining taxable income is $36,250 - $9,845 for a total of $26,405

$26,405 x 15% tax = $3,960.75

Total tax: $984.50 from the lowest tax rate plus $3,960.75 from the highest tax bracket = $4,945.25.

The table displays the total tax paid (i £) on the taxable income for the year.

For instance, someone with a taxable income of £45,000 per year would pay £4,125 plus 20% of (£45,000 - £31,500).

Mark pays a yearly tax of £10,000. What is his taxable income, before taxes, to the nearest £10?

Explanation:

Mark's income must fall into the fourth tax bracket (i.e., he makes between £54,950 and £81,450) if he pays £10,000 in taxes annually.

£10,00,00 - £8,815 = £1,185, where £1,185/0.29 = £4,086.21 must have come from (2dp). The result is £59,040 when added to £54,950. (5sf)

The table displays the total tax paid (in pounds) on the taxable income for the year.

For instance, someone with a taxable income of £45,000 per year would pay £4,125 plus 20% of (£45,000 - £31,500).

Joanne has a monthly taxable income of £4,000 per year. What amount, as a rough percentage of her monthly salary, must she save if she wishes to set aside enough money each month to pay her taxes for the entire year?

Explanation:

£4,000 per month = £48,000 per year, i.e. 3rd tax bracket

Tax for the year = £4,125 + [ 20% x (£48,000 – £31,500) ] = £4,125 + 20% x 16,500 = £4,125 + 3,300 = £7,425

Percentage of income = (£7,425 / £48,000) x 100 = 15.5% (3sf)